Around the concept of trading , being aware of when you ought to get out of a buy and sell is as essential when understanding when you ought to get into one. This is when take profit trader stages come into play. However how do you determine these stages together with precision? Type in complex analysis—a tool that can assist dealers determine maximum carry revenue factors as a result of data-backed insights.

Being familiar with Specialized Analysis

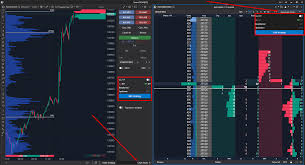

Techie examination includes analyzing recent market details, primarily price and amount, to help forecast foreseeable future cost movements. As opposed to basic examination, that looks at any firm’s financials, technological examination specializes in designs in addition to indicators who have historically estimated price movements. Simply by being familiar with all these behaviour, experienced traders might make advised options about while to shut their particular opportunities for max profit.

Symptoms that Manual Carry Revenue Ranges

Various technological indicators might manual dealers within environment acquire income levels. Going averages, for instance, help distinguish trends. In the event that the purchase price is usually over a relocating average, it may continue upward, hinting an improved consider profit level. However, if perhaps it’vertisements below, the buzz could be downhill, indicating a lesser carry profit point.

Comparable Power Directory (RSI) can be another valuable tool. That measures the velocity and change of price movements. A superior RSI may possibly advise that a resource will be overbought, signaling a potential drop in addition to helping professionals go with a carry profit degree prior to price tag declines.

Using Fibonacci Retracement Stages

Fibonacci retracement stages derived from the thought that markets may retrace any foreseen area of some sort of move, after they will continues so that you can move your stuff in the main direction. Traders apply important Fibonacci ranges (23.6%, 38.2%, 50%, 61.8%, in addition to 100%) to line take profit points. All these degrees work as prospective assist or maybe opposition, aiding traders throughout choosing ought to benefit from profits.

In the end, learning the art of environment acquire profit quantities can easily drastically impact your current trading success. By way of using complex analysis methods such as switching averages, RSI, along with Fibonacci retracement, professionals will make knowledgeable options that enhance their possibilities of acquiring profits. Whilst no technique warranties achievement, technical analysis offers an arranged method to driving the actual unstable waters with trading , presenting your arranged borders around figuring out when you quit your trade.